One impulsive entry can erase weeks of discipline. In trading, FOMO occurs during rapid price movements when traders fear missing profitable opportunities. This emotional response often overrides disciplined decision-making and leads to impulsive entries.

You’ll learn why this fear feels so strong, how it slowly hurts profits, and how to spot the signs before damage happens. We will also cover easy ways to control emotions, follow rules, and build daily habits that support calm trading.

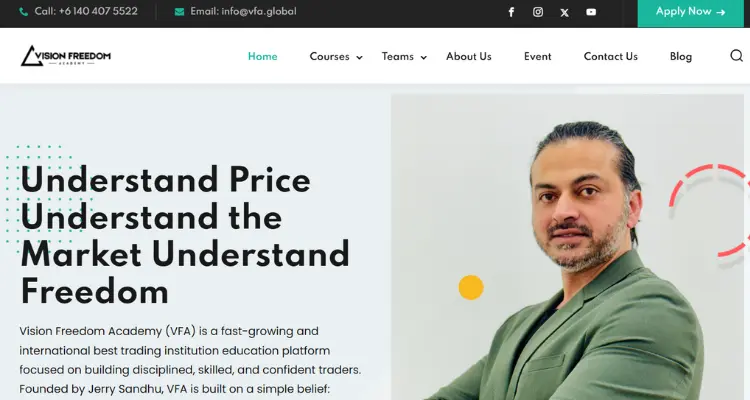

You’ll see how Vision Freedom Academy focuses on mindset, discipline, and process over quick profits. If you want to trade with more control and less stress, keep reading and take your first step toward disciplined trading today. In this blog, we will explain what FOMO is in trading in very simple words.

What Is FOMO in Trading?

FOMO in trading happens when you see a stock or market moving fast and feel scared that you will miss the chance to make money. Your mind says, “Everyone is buying… I should buy one too.” This fear makes traders jump into trades without thinking clearly.

So, what is FOMO in trading in simple words? It is when emotions control your decisions instead of your plan. The meaning of FOMO in trading is the fear of missing opportunities that pushes traders to act without thinking. You stop waiting for the right time and start chasing the move. Most of the time, this leads to bad entries, quick losses, and regret instead of profits.

Read More- Role of Day Trading Psychology in Effective Risk Management

Why FOMO Feels Impossible to Control for Most Traders

Understanding the FOMO meaning in trading helps explain why it feels so hard to control. Trading emotions are very strong. When prices move fast, traders start emotional trading instead of calm thinking. The brain reacts quickly and pushes impulsive decisions, even when the trade does not match the plan.

Many traders also feel a deep fear of missing opportunities, especially after seeing others make profits. This fear creates pressure to act fast, not smart. Over time, this habit becomes normal, and traders repeat the same mistakes again and again. Without clear rules and discipline, emotions take control, and FOMO in trading feels impossible to stop.

How FOMO in Trading Slowly Destroys Profits

This section explains the emotional reasons behind FOMO in trading and shows how thoughts, habits, and outside influences affect trading decisions.

- Late trade entries: Traders enter after the price has already moved because they fear missing the move. This leaves very little profit room and increases the chance of quick reversals and losses.

- Poor risk-reward: When trades are taken emotionally, stop-loss becomes large while profit targets stay small. Over time, even winning trades cannot recover the losses caused by bad risk balance.

- Ignoring stop-loss: FOMO makes traders hope instead of act. They avoid closing losing trades, thinking the price will return, which often turns small losses into large account damage.

- Overtrading: After missing one move, traders take many low-quality trades. This increases fees, stress, and mistakes, making profits harder to achieve consistently.

- Emotional losses: Constant stress, regret, and self-doubt weaken focus. Emotional pressure leads to more impulsive decisions, creating a cycle that slowly destroys trading confidence and results.

Read More- How to choose the best Futures Trading Institute

Psychological Triggers Behind FOMO

This section explains the emotional reasons behind FOMO in trading and shows how thoughts, habits, and outside influences affect trading decisions.

Fear of Being Left Behind

Traders feel stressed when prices move without them. Seeing others enter trades creates anxiety and self-doubt. This fear pushes traders to rush into positions without waiting for proper confirmation or following their trading rules.

Social Media Pressure

Profit screenshots and winning stories online make trading look easy and fast. Traders start comparing results and feel they are failing. This pressure weakens patience and leads to emotional trading driven by comparison rather than logic.

Need for Quick Rewards

Many traders want fast money and instant success. When markets move quickly, the brain seeks quick rewards. This desire reduces discipline and leads to impulsive entries rather than calm, well-planned trades.

Recognizing the Signs of FOMO

Learning to spot early FOMO signs helps traders pause, think clearly, and stop emotional mistakes before losses grow bigger quickly.

Entering Trades Without a Plan

When FOMO appears, traders enter positions without a clear plan or rules. They act on fear and urgency, skipping analysis. These unplanned trades usually end in losses and leave traders confused about what went wrong.

Chasing Fast Price Moves

Traders affected by FOMO often chase prices that are already moving fast. They enter late, hoping the move continues. In most cases, the price reverses, trapping them in poor trades with high stress.

Increasing Trade Size Emotionally

FOMO can make traders increase trade size to recover missed profits. This emotional decision raises risk sharply. One wrong move can cause heavy losses, damaging both the trading account and mental confidence.

Ignoring Risk Rules

Under FOMO pressure, traders forget basic risk rules. They avoid stop-losses and break position limits. Protecting capital feels less important than chasing profit, which slowly destroys discipline and long-term trading survival.

Read More- Why Traders Lose in Futures and How VFA Academy Helps You Beat the Odds

How to Control FOMO in Trading Using a Structured Learning Approach

Structured learning helps traders control emotions, follow rules, and build consistency by focusing on process, not short-term profits over time.

- Follow a clear trading plan: A written plan removes guesswork. Entries, exits, and risk limits are decided before trading, reducing emotional decisions during fast market moves.

- Train trading psychology daily: Understanding emotions helps traders pause instead of reacting. Psychology-focused learning builds patience, discipline, and confidence to wait for the right setups.

- Stay consistent with rules: Repeating the same process daily creates stability. Consistency matters more than single wins and protects traders from impulsive behavior.

- Process over profits mindset: At Vision Freedom Academy, traders are taught to respect process first. Profits become a result of discipline, not emotional chasing.

Daily Trading Habits That Help Traders Beat FOMO

Daily habits help traders stay calm, follow rules, and how to avoid fomo in trading during fast-moving markets and sudden price changes.

Structured Trading Routines

Following a fixed daily routine brings clarity. Planning trades before the market opens reduces panic, improves focus, and helps traders wait patiently for setups instead of reacting emotionally.

Limited Screen Time

Watching charts nonstop increases stress and temptation. Reducing screen time helps traders how to avoid fomo in trading by trusting their plans instead of chasing every market move.

Regular Trade Reviews

Reviewing trades daily builds self-awareness. Traders can spot emotional mistakes, understand patterns, and slowly replace FOMO-driven actions with disciplined decisions.

Psychology Awareness

Understanding emotions during trading is essential. When traders notice fear, greed, or excitement early, they can pause and learn how to avoid fomo in trading through impulsive actions.

Read More- Why Price-Based Trading Beats Time-Based Trading Every Time

How Vision Freedom Academy Trains Traders to Control FOMO in Trading

Vision Freedom Academy focuses on mindset first, teaching traders that discipline, psychology, and structured habits matter more than indicators when learning how to control fomo in trading.

Psychology-First Trading Education

Unlike most programs, Vision Freedom Academy teaches day trading psychology before setups. Traders first understand fear, greed, and patience, learning to spot FOMO early. This mindset helps them stay calm, think clearly, and make disciplined decisions during fast market moves. Understanding the fomo meaning in trading from a psychological perspective is the foundation of this approach.

Rule-Based Execution Over Gut Feeling

At Vision Freedom Academy, every trade follows strict rules. Entries, exits, sizing, and stop-loss are planned early, removing emotional choices and stopping FOMO by letting systems decide actions calmly and consistently. This is a core strategy for how to control fomo in trading.

Building Trading Discipline Through Repetition

Discipline is built through daily practice at Vision Freedom Academy. Traders use journaling, repetition, and accountability to form habits. The focus stays on consistency over quick wins, training minds to value process, not profits, which weakens FOMO and improves trading behavior.

Emotional Control as a Core Skill

At Vision Freedom Academy, emotional control is trained as a skill. Traders learn techniques to manage stress, handle losses, and stay neutral during wins, using breathing, mental resets, and detachment. Recognizing emotions early and choosing rational responses helps traders how to control fomo in trading effectively.

Structured Learning Pathways for Every Level

Vision Freedom Academy offers multiple programs designed to meet traders at different stages of their journey. Each program addresses the meaning of fomo in trading through structured learning and emotional training:

Price-Based & Institutional Trading Mastery

- Duration: Self-paced with ongoing support

- Level: Intermediate to Advanced

- Focus: Understanding institutional order flow and market structure

- Description: Learn how institutional players move markets and align trades with real money flow, not retail emotions or FOMO traps.

VFA Ultimate Experience Program

- Duration: 9-week intensive program

- Level: Beginner to Intermediate

- Format: Live mentorship with real-time trade execution

- Description: Hands-on guidance building confidence and emotional control through live trading sessions with experienced mentors modeling disciplined execution.

VFA Elite Mastermind Program

- Duration: 13 weeks

- Level: Advanced and serious committed traders

- Mentorship: One-on-one guidance with founder Jerry Sandhu

- Students: Limited to 125 participants

- Lessons: 19 comprehensive modules

- Language: English

- Certification: Yes, upon completion

- Description: Flagship program teaching the Price-Based Trading Model. Builds mindset, sharpens execution, and develops mental discipline to trade without fear or impulsive behavior.

Conclusion

Many traders lose money not because of the market, but because they act too fast. It starts in the mind. When traders learn how to control fomo in trading, they stop chasing moves and start making calm decisions. Missing a trade no longer feels painful. Losses feel manageable.

Confidence comes from discipline, not luck. This is why focusing on mindset, rules, and daily habits matters more than quick profits. At Vision Freedom Academy, the goal is simple: help traders think clearly, stay patient, and follow the process over emotions.

When your mind is strong, FOMO loses power. Understanding what is fomo in trading and the meaning of fomo in trading gives traders the awareness they need to succeed. If you want to trade with control, clarity, and confidence, start by mastering your mindset first. Take the first step today and choose disciplined trading over emotional reactions.

FAQ’s

Q1. Why does FOMO affect beginner traders more than experienced ones?

Beginners lack confidence and structure, so fast market moves create panic. Without clear rules, emotions take control and lead to rushed, unplanned trading decisions.

Q2. How does FOMO impact long-term trading performance?

FOMO causes repeated small mistakes like late entries and overtrading. Over time, these habits slowly drain capital, confidence, and discipline, making consistent profits very difficult.

Q3. Can following a trading plan really reduce FOMO?

Yes, a clear trading plan removes guesswork. When rules decide entries and exits, traders feel less pressure to act emotionally during fast market movements. This is the fomo meaning in trading control in practice.

Q4. How does trading psychology help in controlling FOMO?

Trading psychology helps traders notice fear early. Understanding emotions allows them to pause, think clearly, and choose disciplined actions instead of reacting impulsively.

Q5. Do trading mentors help traders manage FOMO better?

Yes, guidance provides structure and accountability. At Vision Free Academy, traders are taught to focus on mindset, discipline, and process to reduce emotional trading.

Q6. Does FOMO affect profitable traders, too?

Yes, even profitable traders feel FOMO sometimes. The difference is they don’t act on it. Discipline and experience help them stay calm and follow rules.

Q7. Can taking breaks from trading reduce FOMO?

Yes, breaks help clear the mind. Stepping away from screens reduces stress and emotional pressure, making it easier to return with a calm and focused mindset.

Q8. How does journaling help reduce FOMO?

Journaling helps traders spot emotional patterns. Writing mistakes down builds awareness, making it easier to pause and avoid repeating FOMO-driven decisions.

Q9. Is FOMO worse during volatile markets?

Yes, fast-moving markets increase fear and urgency. Sudden price changes trigger emotional reactions, making FOMO stronger when traders lack preparation or structure.

Q10. How can traders practice controlling FOMO outside live markets?

Traders can practice by using paper trading, replaying charts, and reviewing past trades. This builds confidence, improves discipline, and reduces pressure before trading with real money.